Commercial directing. Photograph by Alex Chiu

Are you a filmmaker, actor, writer, musician or artist? If you are a hard worker, this can be your reality!

In this blog, I’ll show you how you can earn a six figure income by sharing you the formula I’ve used. As a filmmaker that struggled, I always found it difficult to land stable jobs. I love what I do, but my work is unpredictable. Ten years ago I started the path to become financially stable, I wanted to provide for my family. It changed my life – and it can change yours too!

Though we all say we want success, it is likely that 99% of the people will not do anything after reading this blog. It’s not surprising, that is why about 1% of the population controls most of the wealth based on this documentary. My point is, for most of us, wealth does not come easy or quick. The problem is that the majority of the people either don’t know the formula, or, they know it but realized how difficult it is to obtain and gave up. To become financially stable, you need to look at life differently. Debt is not a bad thing, it depends on how you use it (Fig 3.). Let’s get started:

1) Do something about it:

Why doesn’t my boss give me a raise? Why is everything so expensive? Why is my landlord always raising rents? Are these some of the questions that you ask yourself? Then you might want to ask: “What can I do about this?” As soon as you change your way of thinking and stop blaming society, you’re half way there. As Grant Cardone says in his book “Don’t Be a Little Bitch”. (Chp 6, The 10X Rule).

Take this story for example. An Australian Tracy Harvey was one of four kids being brought up by a single parent who was on welfare. She blamed her situation on everyone. One day with two of her own kids and being a single mother, she came close to being evicted and becoming homeless. At that moment, she decided she wanted a better life for her children, she asked herself a question: “what can I do about this?”. She picked herself up and did something about it. She started reading books about real estate and investing and after being rejected by many banks, she finally got a loan for her first property. Later, she got herself an education. She was also able to buy four properties on a $30k annual income, now she owns 10 income properties according to this news interview.

Instead of blaming on external factors, ask yourself the question: “What can I do about this?” Think of a solution, do something about it. Opportunities don’t come to you, you have to make them happen.

Once one realizes that they can change as an individual, they will need to change their mindset in the way they look at money. This brings me to my next topic.

2) Buy investments to support your artistry:

Because of our career choice, our income is always fluctuating, so it is optimal to seek out alternative income sources that are stable and substantial.

That additional income source can be investments in paper assets, purchasing businesses, or my main interest, real estate. Investment vehicles such as these will take time to build, however it is fundamental that you move your efforts towards creating passive income from these investments. By switching your mind to take precedence over your investments temporarily, you won’t have to worry about your living expenses later on. Once your investments have generated enough passive income to exceed your expenses, then you can shift your efforts back into working on your craft.

A good example of the strategy can be Arnold Schwarzenegger’s story (Fig. 1). When he was a young immigrant arriving to the United States, he did not earn much, however he was able to save every dollar he made. His goal was to purchase an income property. Finally he was able to save around $26k for a six unit apartment building for around $240k which is 10% down. It was perfect for him as he explained in this video. He can live in one unit and rent out the other 5 units. 2-3 years later he sold it for twice as much. He then rolled his proceeds into purchasing over more than 100 units in a course of a few years. By the time he got heavily involved in the acting career, he was already worth several millions and he had the time to enjoy doing his craft as his rental income paid for his living expenses.

If you set yourself up with investments like rental properties early on, you will be able to enjoy a steady stream of passive income so you can fully concentrate on your artistry instead of trying to make ends meet.

3) So how do I earn $100k plus annually?

I believe it’s important to share my story because if a guy like me can get to where I am, anyone can do it. Even you.

I’m a millennial from Toronto and was in my second year in theatre school. I knew that my career choices were very slim upon graduating due to my social skills. One day, I unexpectedly stumbled into a book store and saw Rich Dad Poor Dad by Robert Kiyosaki. It changed my life. If I could set myself up with a series of rental properties as described in the book, then I could spend my time pursuing my career without worrying about living expenses.

But, in order to purchase real estate, I needed a loan from the bank. In order to get a loan, the banks wanted an income that I didn’t make. Or they could qualify me with at least 2 years of self employed income, but I didn’t have that either… So I gave up and stopped there.

Just kidding! I formed a business to work for myself. During this time, I saved as much as I could from the proceeds generated from my business. I was able to save around $14k by the time I graduated two years later. That equates to roughly $583 monthly which is around $20 per day. So cut the Latte and make your own lunch and dinner each day!

Another example to get $20 per day is to increase income by washing cars for free. I’m confident that one can earn $20 of tips in one day. Let’s say they washed 6 cars a day, that’s a minimum of $3.33 of tips per car. A more modern approach could be from using apps such as Uber.

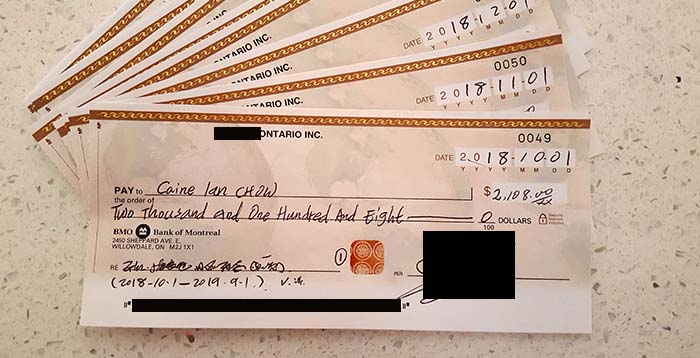

When I graduated, I got the loan from the bank and bought my first house for $278k with $14k down which is 5% (Fig 2.). I partnered up with my girlfriend (now my wife) and she financed the renovations. After the renovations, we rented it out. I held the property for 5 years and sold it afterwards. We took the proceeds and purchased several more houses over the course of a few years. During one of the several transactions, we even used my girlfriend’s school loan as a down payment. If you can imagine, a large part of a school loan are for accommodations anyway, so technically we are using her funds to pay for a mortgage instead of rent. My parents were against all my real estate ventures, but my girlfriend and I learned so much together.

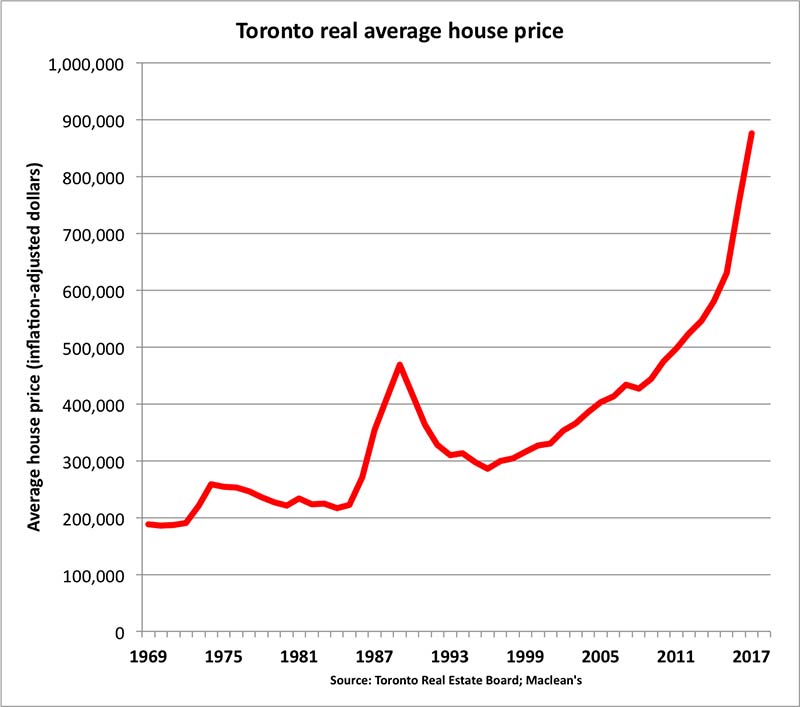

We now own several properties and in the process of securing more rentals. A property I’ve purchased 5 years ago for $432k is now worth close to $1 million as it was appraised recently in 2018. That’s about a $100k increase yearly. That house alone single-handedly took care of all of my children’s University fees and more if it was sold today. And with the assistance of other properties, that is how we earn around $100k annually in appreciation per property.

If real estate is your investment vehicle of choice, then the strategy will be to purchase as soon as possible because the longer you wait, the more difficult it is to afford as seen in Fig 5. Thus in order to purchase early, your down payment will not be substantial because there will be insufficient time to save for it. Therefore, you need to qualify with as little down as possible. I spoke to my banker recently, and 5% down is the minimum in 2018. A traditional bank will normally lend you up to four or five times over your income. However, there are workarounds, which I’ll explain later below. During your early investment period, you’ll need to acquire as much rental properties as possible. Then in the later half, sell your properties that are performing poorly to pay off the mortgage on your better performing assets.

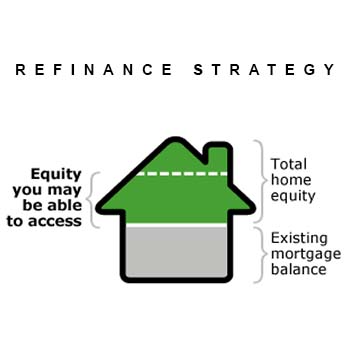

Once you’ve acquired several single family homes similar to my model, you can consider selling or refinancing them (See Fig 4). You can then take the funds to purchase several apartment buildings. These apartment buildings can easily generate over $100k per year each. And that’s how a starving artist can obtain a six figure income! Not bad. But it doesn’t end there.

Once you have acquired several apartment buildings, you may want to trade up to commercial strip plazas, industrial buildings, condominium developments. Several of these investments together can earn you $1 million, $2 million, $3 million per year or more. At this level, most investors will have a staff to help them manage their portfolio.

The possibilities are endless. You can expand as much as you please, or stop whenever you like. The point is that you no longer have to worry about your living expenses. You have control and now have time to work on your career.

There are many other investment opportunities within real estate. For example, there’s the lending industry. If you simply enjoy collecting interest from a borrower without the hassle of property management, this may be a fit for you. It is a common practice within the lending industry. For example, if one borrows $100k at 4.5% and lends it out at 12% the profit is 7.5% which equates to a $625 cheque coming into your account every month! (See Fig 3.)

Another opportunity can be an assignment deal. I will not get involved because it is not a passive form of income. However I mentioned it because real estate entry levels are high and assignment deals may be an easier way to get in, which brings me to my next topic.

Fig 3. An example of how to use debt. One of the smaller deals I’ve made recently was to borrow money to lend it out. Over $2000 of interest is collected monthly from my borrower. It out performs a 9-5 job as I only spent 30 minutes of my time at my lawyer’s office signing paperwork to set this up.

Ways to Get Cash:

As mentioned, to get into real estate you need some cash. But you don’t have cash and that’s why you want to invest in real estate in the first place. In Canada the government has made it even harder to qualify for a loan and with the real estate market rising like they are for the past several years as seen in Fig 5., it makes it difficult for anyone to purchase that don’t qualify. However it is not impossible depending on your risk tolerance. There are unconventional ways to buy (legally).

Howdy partner(s): If you can’t afford it on your own, and if the banks can lend you four to five times of your income as explained by my banker, then you can partner up with someone to go in on title with you. Let’s say you and another partner earn $45k each, then your total income will be $90k. Thus you can afford a budget of $450k. If you qualify for 5% down that equates to $22,500 (plus closing costs). If each partner saved around $11,500 that will equal to $480 per month for 2 years or about $16 per day that you’ll need to save. With that budget, you can most likely purchase something in the suburbs if you live near the Toronto area in Canada. Further, if your desire is to live in the city, then you can hold the property for several years while collecting rent. If the market goes up, sell it and keep repeating this process until you can “buy” your way into the city.

Note that anything under 20% down requires CHMC insurance in Canada which was not added in the example above.

There are also real estate syndication techniques where a group of investors pool their funds together on a larger project in which they cannot do on their own. If one was to purchase a commercial property with over 5 units, they can raise the down payment (more on raising capital). The bank will normally lend 65%-70% in Canada. Thus if a group of investors were able to raise the remaining 35% down, the bank may finance the deal. The group can form a company and the investors can participate as passive members. Profit and distribution rights will be set on the agreement drafted out by an attorney specializing in real estate syndication. Just insure that you do your due diligence and have positive cash flow from your property. Read more about real estate syndication here.

The Private Guy: If the banks won’t lend you the money, someone will. Have you thought of private financing? Some lenders may finance 90% loan to value (LTV). In other words, if you have 10% down, the first mortgage can be borrowed privately. They normally charge between 8% to 10% per annum with interest only payments, usually with a 1 year term, however it’s all negotiable. This is pretty good considering the fact that you’ll own a house with minimal down payment.

For example, you’ll like to purchase a house for $450k and you have 10% down. The private lender will lend you $405,000 with monthly payments of $2,700, interest only. This is about $700 per month more than what the banks (B lenders) will charge in 2018, but if you don’t qualify, this is an alternative. How can you reduce the monthly mortgage payments and start paying the principal? Rent out what you can in your house, and if the market goes up, that means you will have equity in your property (Fig 4.). Then, you can find a bank that will hold the mortgage for you, they will pay out the private lender and this will cut your monthly payments down.

The take back: Okay, sometimes you may find older owners that will have little or no mortgage left on there income properties. And it happens that those are the properties that you are looking for. However, they may be selling because they can’t manage the property due to age. At the same time, they still want to enjoy the passive income their investment brings in. Why won’t you ask them to give you a loan so they can collect interest from you, therefore they can earn that passive income they are seeking for and you’ll own a property?

I’ve recently presented an offer for a triplex under power of sale with this technique. I was trying to think of a way to afford this triplex. Under power of sale, the owner had defaulted and the lender has taken possession of the property. By asking a few questions, I found out that the seller was a private lender. The house was on the market for a long time, and the price has been reduced. He specializes in lending, not property management and as such, he is motivated to sell quickly. I came up with an idea. Since he is a private lender, the probability of a vendor take back structured deal is high. I ended up purchasing the triplex with a loan that he gave me. The entire transaction will be done without a traditional loan from a bank. We have since successfully closed the property.

These are very rare and can be difficult to find as most do not present that option in the listing as per example above. Therefore understanding why the seller is selling is fundamental to structuring the financial component.

Master Lease Options: Another technique is that you can arrange the rights with the seller for you to operate a property as if you were the owner. You will be paying all expenses and repairs on the property except for the mortgage. Instead, you will pay a monthly leasing fee to the current owners. Thus insure your rent covers the expenses and monthly leasing fee. In addition, you will have the option to buy the property in the future at a predetermine price. These are perfect for people starting out the industry, as you may or may not need a down payment. You can close fast and do not require any institutions involved.

Let’s say you found a multi unit property and the owner is willing to take a master lease option arrangement. You will then be responsible for all utility expenses including maintenance and repairs. The expenses and monthly leasing fee adds up to $5000 monthly and you rent it out for $5500 monthly, thus you make $500. In addition you agree to purchase the property at a set price of $500k with an option to entertain it withing the 5 years. On the fifth year, the property is now worth $650k. You can then exit the deal by several methods.

First, you may be able to purchase the property because now that you have equity built up, the probability of qualifying for a mortgage is higher. Alternatively you can do a double close in which you find a buyer to purchase the property at current market value ($650k) and close with the current owner at the set price ($500k) at the same time giving you a $150k profit. Lastly, you can sell your option at a discounted price. Learn more about master lease options here.

The hybrid: In most cases, the banks will lend you the funds if you have 20% down. Let’s say you saved 10% and you need another 10% to close a deal you cannot pass. Why not do a mixture of private and institutional money?

For example, you are approved for a $500k budget at 20% down, you have $50k saved up and you need another $50k from a private lender (aka 2nd mortgage). You may need to disclose that you are borrowing your down payment as some institutions do not allow this. In this scenario, the private lender will charge between 10% to 12%, interest only.

It is more costly to borrow this money because from the lender’s perspective, the risk is higher. Should the borrower default, the bank will always have first priority to recover what is lost before the 2nd mortgage lender can recover their portion. So it’s in the bank’s interest to sell the property just enough to recoup their losses not really taking into consideration of the 2nd lender. However, the 2nd lender can have the option to buy out the property from the bank. Then they can put it on the market and sell the property at a price which will favour them.

On the borrower’s perspective, if you rent out the property, this will help cover some of the mortgage payments and you have a place to call it your own despite of the high debt service. Simply refinance with a conventional mortgage later on to take advantage of the lower mortgage payments.

No money, no problem: If you or somebody willing already has a property, you may consider a collateral structured deal. Essentially in this strategy, the buyer is borrowing money by using one of their other properties to secure it. This enables them to acquire a property with no money down.

For example, you or somebody willing already owns a rental and has about $400k of equity in it (Fig 4.), but you wish to keep your cash in case of emergencies. You would like to purchase another rental that is worth $250k. A lender will finance the $250k if they can secure it against your $400k equity rental also. This transaction works on both sides because the lender is secured against two of your houses and the buyer has another property added onto their portfolio without even touching their cash reserves. The buyer can simply refinance with an institution to relieve the collateral they placed on their $400k equity rental in the future.

The above outlines the basics of what an investor can do. An investor can use one or several combinations of the financing models explained above to purchase a property. Whenever you find a property that may seem out of grasp, don’t tell yourself that you can’t afford it, instead ask yourself how can you afford it.

Whatever financing deal you put together, always pay promptly whether it’s private or through an institution. Having a strong credit score is beneficial. The underwriter trusts that you will pay the debt back, that is why they approved you. They are held responsible should a series of defaults occur. Be truthful as long term successful track record is very important in this industry. Thus, working out your income and expenses to see whether the property can carry itself with profits are crucial.

Fig 5. MaCleans Source for home prices in Toronto Canada from 1969 to 2017.

A Greater Responsibility

Forget timin’ the market, it’s time in the market. Real estate will rise over time. If you stay in it long enough you’ll gain as one can see in this 128 years of growth in real estate. Although Toronto housing may be expensive, you have to realize that we live in a city where prices cannot even be compared to Hong Kong, Los Angeles and San Francisco.

This blog is geared primarily towards real estate because if you do a search, a large majority of successful individuals have acquired their wealth through real estate (watch video). Thus, going into this industry will yield the highest probability of success. However there are many other investment options that are also worth exploring that are beyond the topic of this blog.

In summary, your artistry should be something that you enjoy doing, it doesn’t need be part of a primary income source to pay for your bills. Your lifestyle can be supported by your investments that you’ve established from early on. Those are stable and can support you through the journey towards your career.

There are greater things in life than money. Most acquire wealth to spend more time with their children and family, create a legacy after they pass, donate to their favourite charity, what’s yours? Whatever your objective may be, always remember to be humble, ethical, and give back to your society one day. It is our developed country that we’re currently living in which helped enable us to make it to where we are in the first place.

Thanks for sticking to the end. I’ll leave you with a final quote: 97% of the people who quit too soon are employed by the 3% that never gave up. You can reach your objective in life should you choose to do so.

DISCLAIMER: Please seek a professional before attempting any financial investment. This material is for general information only.